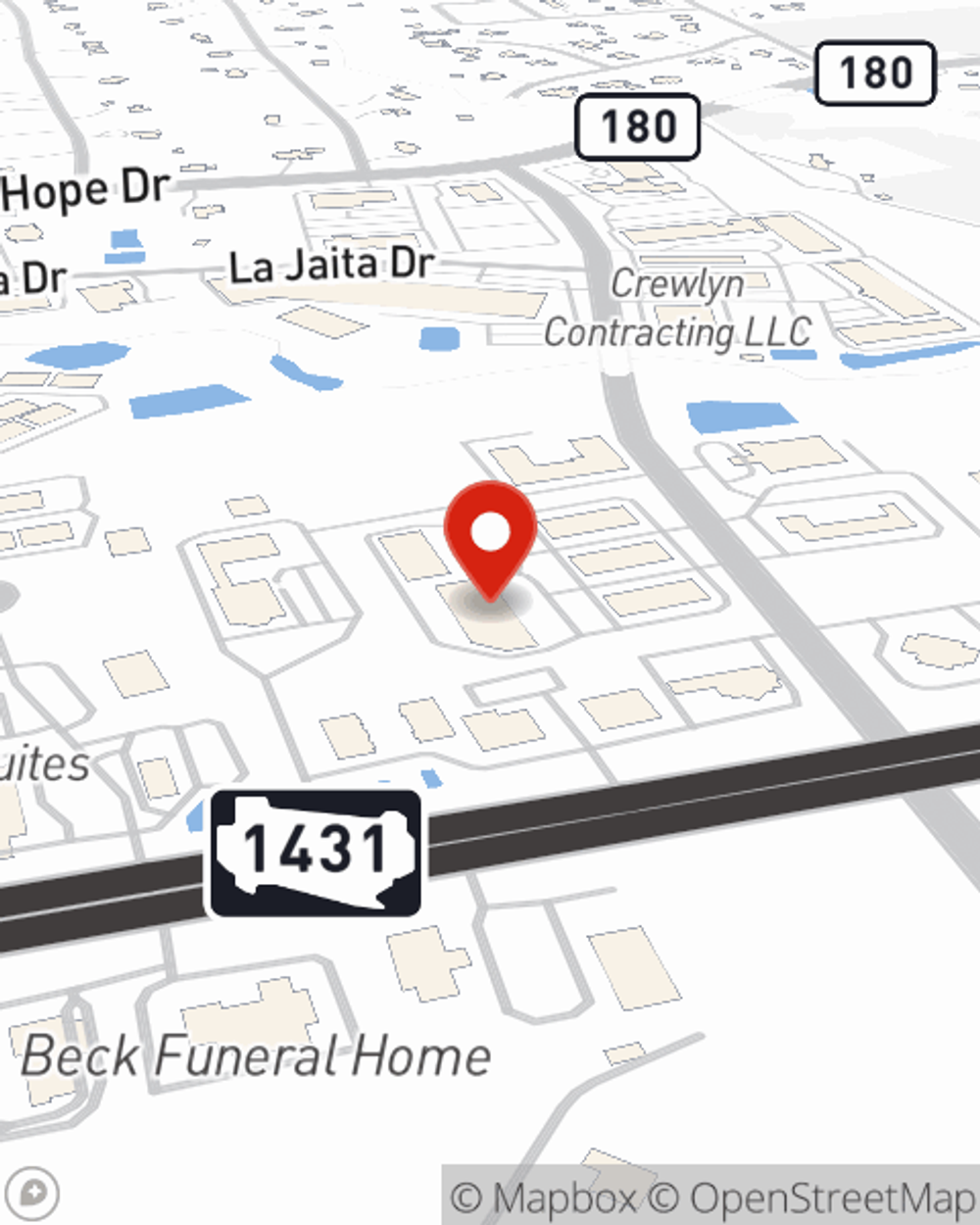

Homeowners Insurance in and around Cedar Park

Homeowners of Cedar Park, State Farm has you covered

Help cover your home

Would you like to create a personalized homeowners quote?

- Austin

- Cedar Park

- Leander

- Liberty Hill

Home Is Where Your Heart Is

Your house isn't a home unless you're insured by State Farm. This excellent, secure homeowners insurance will help you protect what you value most.

Homeowners of Cedar Park, State Farm has you covered

Help cover your home

Protect Your Home Sweet Home

You’ll get that and more with State Farm homeowner’s insurance. State Farm has coverage options to keep your largest asset safe. You’ll get a policy that’s personalized to fit your specific needs. Thankfully you won’t have to figure that out by yourself. With true commitment and outstanding customer service, Agent Shannon Johnson can walk you through every step to set you up with a plan that safeguards your home and everything you’ve invested in.

Excellent homeowners insurance is not hard to come by at State Farm. Before the unpredictable transpires, reach out to agent Shannon Johnson's office to help you get the home coverage you need.

Have More Questions About Homeowners Insurance?

Call Shannon at (512) 258-5834 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.

Shannon Johnson

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Smart steps to ladder safety

Smart steps to ladder safety

Do you know the right ladder height for the job? Ladder-related injuries result in thousands of trips to the ER each year. Learn how to use a ladder safely.